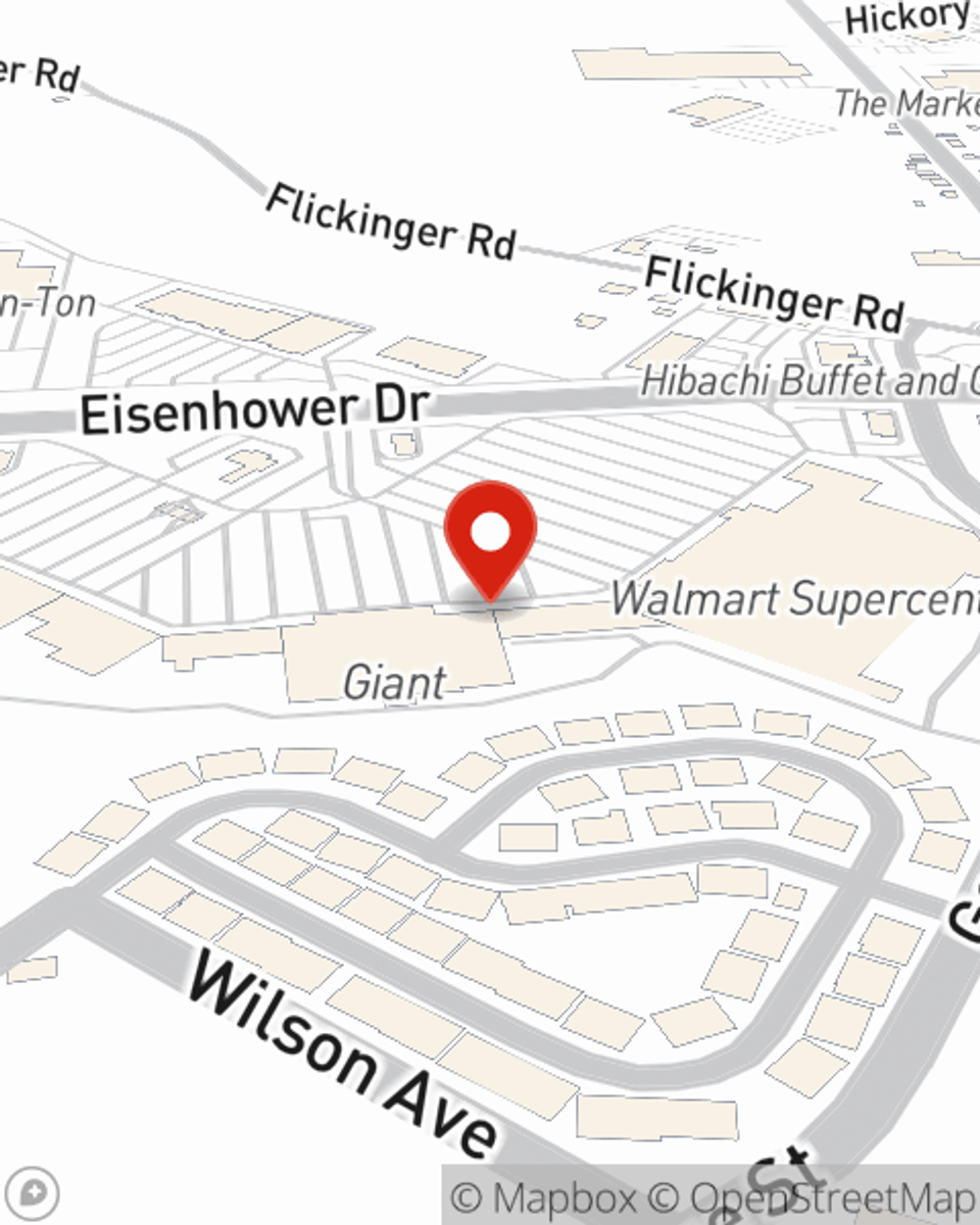

Business Insurance in and around Hanover

Searching for protection for your business? Look no further than State Farm agent Nicole Grove!

Helping insure businesses can be the neighborly thing to do

Help Protect Your Business With State Farm.

Operating your small business takes creativity, commitment, and quality insurance. That's why State Farm offers coverage options like business continuity plans, extra liability coverage, a surety or fidelity bond, and more!

Searching for protection for your business? Look no further than State Farm agent Nicole Grove!

Helping insure businesses can be the neighborly thing to do

Customizable Coverage For Your Business

When you've put so much personal interest in a small business like yours, whether it's an alteration shop, a book store, or a yogurt shop, having the right coverage for you is important. As a business owner, as well, State Farm agent Nicole Grove understands and is happy to help with customizing your policy options to fit the needs of you and your business.

Call or email agent Nicole Grove to consider your small business coverage options today.

Simple Insights®

How to do small business inventory

How to do small business inventory

Learn more about small business inventory, including types, tracking tools and strategies to help your business succeed.

How to grow your small business

How to grow your small business

Growing a small business takes strategic planning and research. Consider these helpful tips on ways to grow a small business to help ensure future success.

Nicole Grove

State Farm® Insurance AgentSimple Insights®

How to do small business inventory

How to do small business inventory

Learn more about small business inventory, including types, tracking tools and strategies to help your business succeed.

How to grow your small business

How to grow your small business

Growing a small business takes strategic planning and research. Consider these helpful tips on ways to grow a small business to help ensure future success.